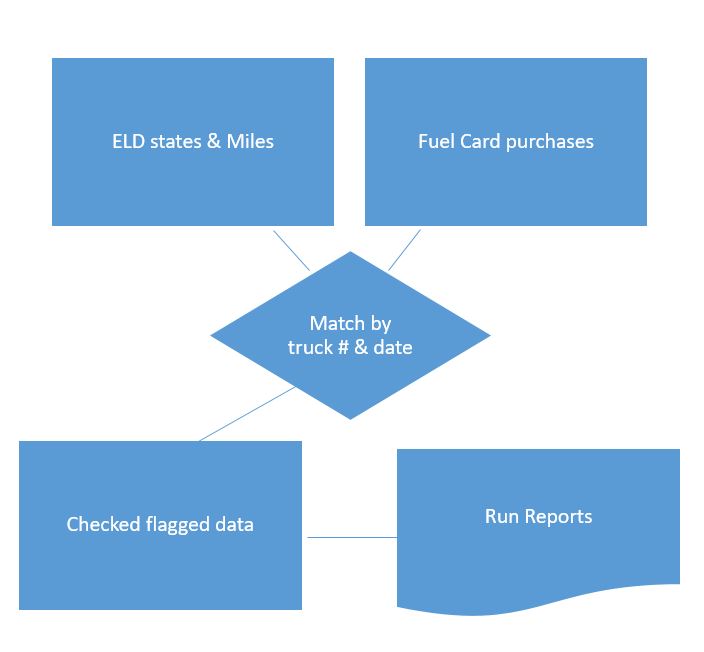

We, at TMS Digital, offer among our suite of Transportation Software programs, an easy to use program called IFTA Manager. Our IFTA Tax Calculator program imports from your trucks’ ELDs and from your fuel card, marries them together based on truck number and date to creates trips. In turn, this allows you to run one of our numerous built in IFTA reports which automatically calculate your fuel MPG and determine your over/under miles and fuel purchases, using the most current IFTA formulas for each state.

However, our sales department has noticed, that we get many inquiries wanting to know how IFTA works, how to get a permit and how to report IFTA. Our IFTA Manager app does the calculations so you have all the info you need to file, but because we like to be as helpful as we can, we will also answer some of the most common questions about IFTA.

What is IFTA?

The International Fuel Tax Agreement (or IFTA) is an agreement between the lower 48 states of the United States and the Canadian provinces, to simplify the reporting of fuel use by motor carriers that operate in more than one jurisdiction.[1] Alaska, Hawaii, and the Canadian territories are not required to participate, however all of Canada and Alaska do. An operating carrier with IFTA receives an IFTA license and two decals for each qualifying vehicle it operates. The carrier files a quarterly fuel tax report. This report is used to determine the over/under taxes and redistributes these taxes between the states traveled in. This tax is required for motor vehicles used, designed, or maintained for transportation of persons or property and:

• The Power Unit has two axles and a gross vehicle weight or registered gross vehicle weight in excess of 26,000 pounds, and/or

• The Power Unit has three or more axles regardless of weight, and/or

• is used in combination, when the weight of such combination exceeds 26,000 pounds gross vehicle or registered gross vehicle weight.[2]

Source: https://en.wikipedia.org/wiki/International_Fuel_Tax_Agreement

How do you calculate IFTA?

You do not! You let our IFTA Manager program do all the heavy lifting. But, if you want to do it the hard way, you need to know:

- how many miles your truck drove through each state.

- how many gallons of fuel your truck purchased in each state

- the type of fuel

- total miles

- total fuel

- what miles were considered taxable.

And, there is more. Ok, my head hurts. If it was me, I would rather have the easy to use IFTA module from our suite of TMS Digital software calculate all this for me! And if you make any errors in your manual calculations, you pay a hefty fine! To read more about doing it the hard way, Florida has a well written pdf with more detail: Click Here

How do I get an IFTA Permit?

Your first step is to decide where your base jurisdiction is. Your base jurisdiction is where

• your qualified motor vehicles are based for vehicle registration purposes;

• the operational control and operational records of your qualified motor vehicles are maintained or may be made available; and

• Some miles are accrued by qualified motor vehicles within a fleet.

For example, if your base jurisdiction is Illinois, you must electronically submit Form MFUT-12, Application for Motor Fuel Use Tax, IFTA License, and Decals, using MyTax Illinois to register for motor fuel use tax and receive proper Illinois IFTA credentials.

If Illinois is not your base jurisdiction, you must contact the state or province in which you are based for specific registration instructions.

Decals are issued in sets of two. One set of decals is required for each qualifying vehicle you intend to operate.

Should I apply for an IFTA license?

If you are based in a member jurisdiction and operate a qualified motor vehicle in 2 or more member jurisdictions, yes. If you usually operate your vehicles only in one jurisdiction, but make occasional trips outside the base jurisdiction, you may elect to purchase trip permits for that occasional travel. Permitting services can usually be contacted from any major truck stop. Contact a permitting service for rates.

What if I have qualified motor vehicles in more than one jurisdiction?

It is important that you contact one of those jurisdictions. You may be able to consolidate your operations under one license. The jurisdiction you contact will assist you and give you information on how that can be accomplished.

IFTA Refunds (I hear it happens)

Read about how on the IFTA site.

https://www.iftach.org/links.php

For more information about IFTA reporting mileage calculator and how to file IFTA, you can get it straight from the horse’s mouth!

https://www.iftach.org/

I hope this was helpful?

If you have a small fleet, you may not mind tracking all this data and doing manual calculations. However, as you start growing your fleet, this task can start becoming cumbersome and then overwhelming.

Let us help! IFTA Manager does all the work for you. It is easy to use and we can even automate some of the imports from your ELD (we currently import from OmniTracs, Samsara, Keep Truckin’ and Geo Tab, and are adding more interfaces all the time!) or Fuel Card downloads. IFTA Manager calculates the usage based on the most current state tax formulas downloaded directly from the IFTA www.iftach.org site. Built in reports give you the information you need to fill out your forms. There are even reports to help you with troubleshooting, so you do not miss uncommitted fuel and you can easily identify problem trips.

Contact us today and ask for a demo! We are your premier transportation software provider!

Just click the bright little orange button in the upper right hand corner!