In the fast-paced trucking world, your time and attention must be focused on the most important aspects of running your business. One area that requires a lot of time and attention and is related to the success or failure of your company – is IFTA filing.

If you don’t know what this is, don’t worry – we are here to explain all you need to know about IFTA filing and why it’s so crucial for trucking success.

Why Prompt and Accurate IFTA Filing is Essential?

For those who own and operate a business, especially in the trucking industry, you know how important it is to be accurate, timely, and thorough with your filings. This is especially true in the case of International Fuel Tax Agreement (IFTA) filing. IFTA filing is required by every state that has a fuel tax and is essential to trucking success.

This means that trucking companies carrying fuel in their vehicles across state lines must file the correct fuel tax back to those states quarterly. This is how states can collect the fuel tax they charge on all purchased fuel.

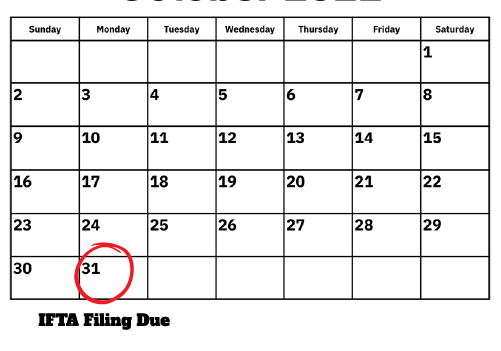

IFTA Filing Due Dates

- For Q1 (January to March): April 30

- For Q2 (April to June): July 31

- For Q3 (July to September.): October 31

- For Q4 (October to Dec.): January 31

Four times a year, over and over, and here we are again! The third Quarter 2022 IFTA filing due date is October 31, 2022. We at TMS-Digital feel your pain. Let our IFTA Manager software take the sting out of your quarterly IFTA reporting.

What Are the Penalties for Incorrect or Late IFTA Filing?

While you may be tempted to ignore IFTA filing, the penalties for doing so are steep. Penalties vary from state to state, but many states charge a percentage of the fuel tax owed to the state.

If a report is not filed, is filed late, or is not paid for in full, there is a penalty of $50 or 10% of the tax due, whichever is higher.

If you operate a large trucking company with a fleet of trucks transporting fuel across the country, you could have a hefty amount of penalties just from not filing IFTA correctly and on time.

No matter the size of your fleet, we can help you streamline the collection of state miles and fuel receipts by working with your ELDs and fuel card companies to turn that data into easy-to-understand reports. More information on how you calculate IFTA.

Bottom Line

Prompt and accurate IFTA filing is essential to trucking success and your success. There is no more important task for a trucking company than ensuring they file all of their taxes correctly and on time. For many trucking companies, IFTA filing can seem like a daunting task. That is why it’s essential to use a service that makes IFTA filing easy and accessible and provides excellent customer service.

With decades of experience, TMS-Digital has become the trusted source for trucking software. We understand the industry’s challenges and are dedicated to helping you succeed.

Using “behind the scenes” formulas, the IFTA manager utilizes a custom color-coding system to instantly alert you to any discrepancies or missing data. We helped one of our customers find that their ELD had half of the fleet out in the middle of the Pacific Ocean! That would have been an interesting filing to IFTA.

The bottom line is that almost all jurisdictions have entered into the International Fuel Tax Arrangement known as IFTA. Hence, there is virtually no way to get around having to file, but there is still time to join the TMS-Digital team and let us be your one-stop solution, so you handle the important stuff. The next due date is the end of October, so what are you waiting for? Contact us today and get help with IFTA.